Our Services

Variable Capital Company (VCC)

The Variable Capital Company (VCC) is a new corporate structure for investment funds constituted under the Variable Capital Companies Act which took effect on 14 Jan 2020. The VCC will complement the existing suite of investment fund structures available in Singapore.

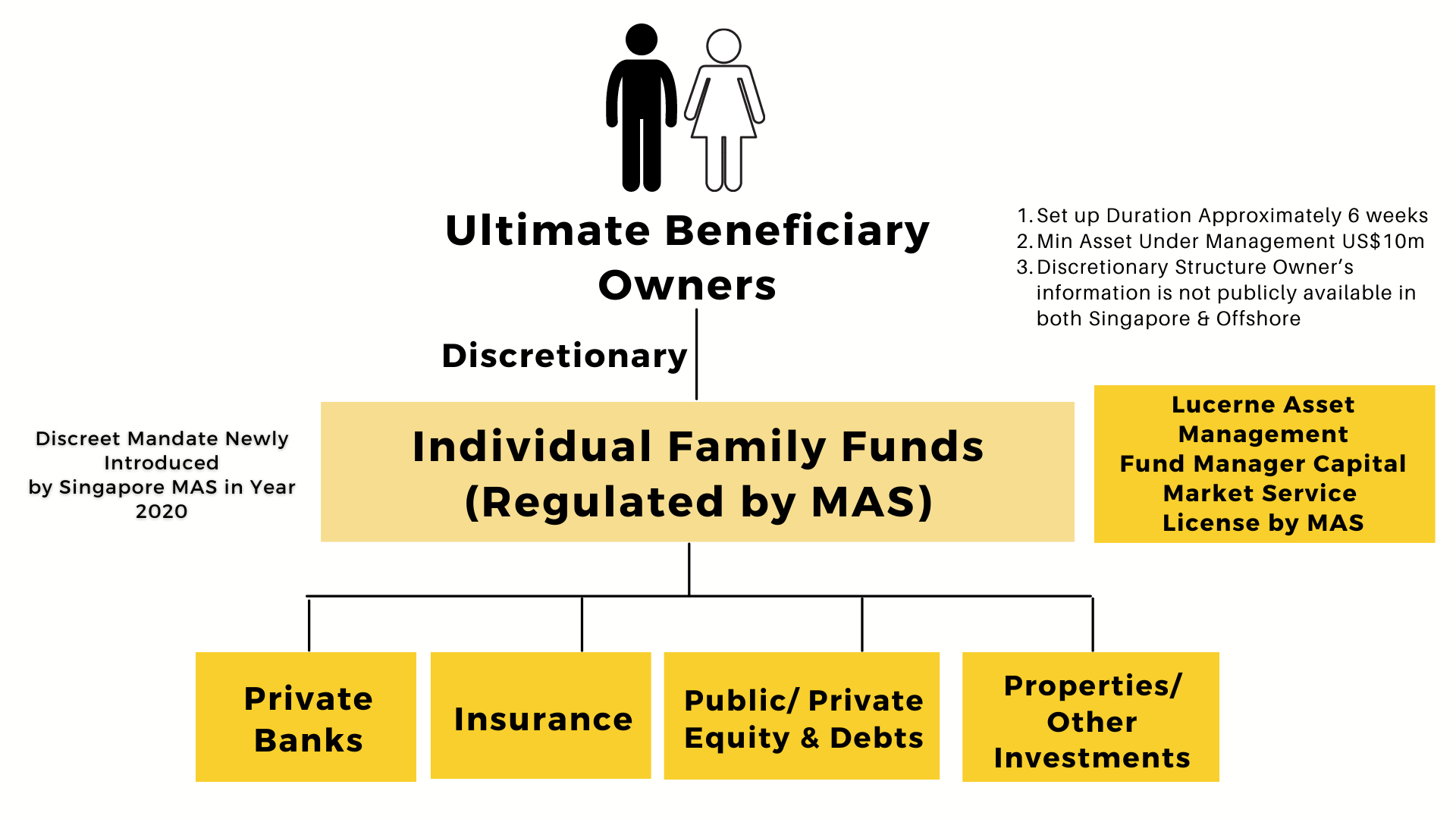

VCC Structure

The VCC Act and subsidiary legislation is administered by ACRA. All VCCs must be managed by a Permissible Fund Manager. The antimoney laundering and countering the financing of terrorism obligations of VCCs will come under the purview of the Monetary Authority of Singapore (MAS).

The VCC provides an additional Structuring option to attract global fund managers to use Singapore as their investment base

Fund managers can incorporate new funds or re-domicile their overseas funds as VCCs with ACRA

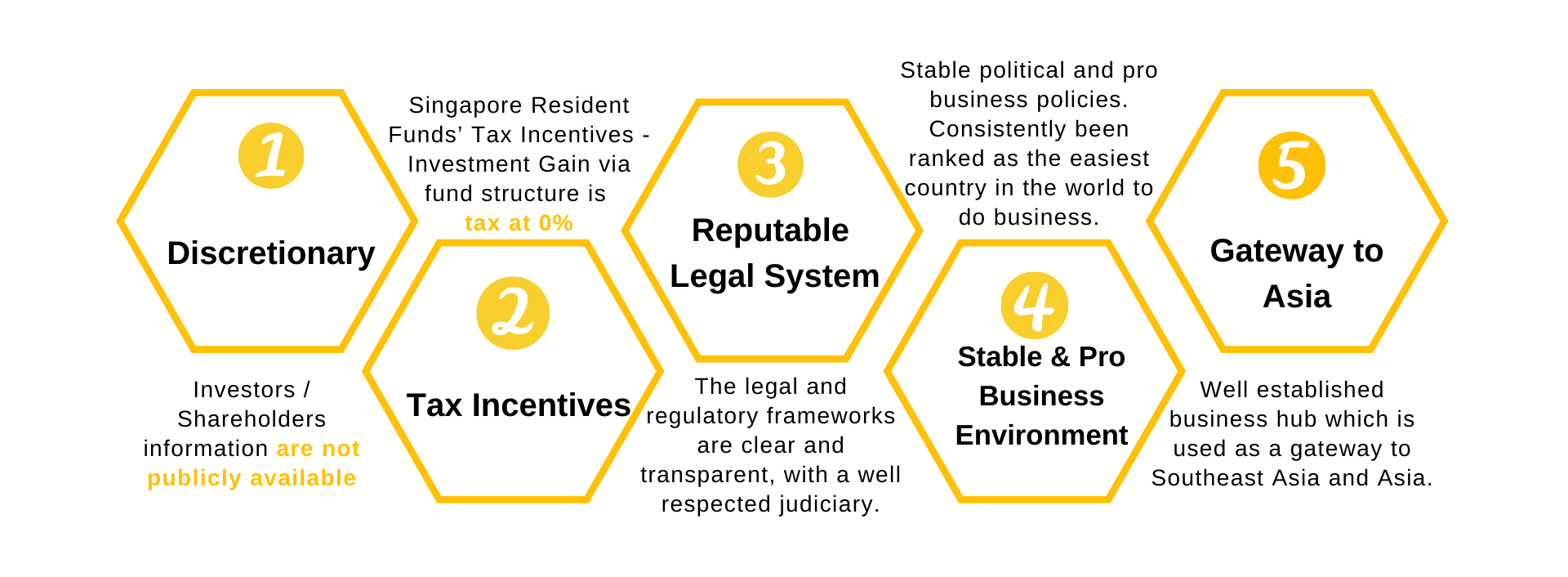

Why Setting Fund under VCC Structure?

Key Features and Benefits

- Greater flexibility in issuance and redemption of shares as well as payment of dividends out of capital

- Enhanced safeguards by segregation of assets and liabilities in each sub-fund

- Can be used for all traditional and alternative strategies, and structured as either open-ended or closed-ended fund

- VCC is treated as a single entity for tax purposes and also eligible for tax exemption

- VCC must be managed by a fund manager regulated by MAS

- Foreign corporate entities can re-domicile to Singapore as VCCS