Our Services

Family Office

Family office is an organization that gathers senior investment consultants, certified public accountants, lawyers and other professionals to provide a full range of wealth management services for high-net-worth family clients – covering family trust, tax planning, asset management, private legal services, butler services and more – it is the highest-end form of wealth management.

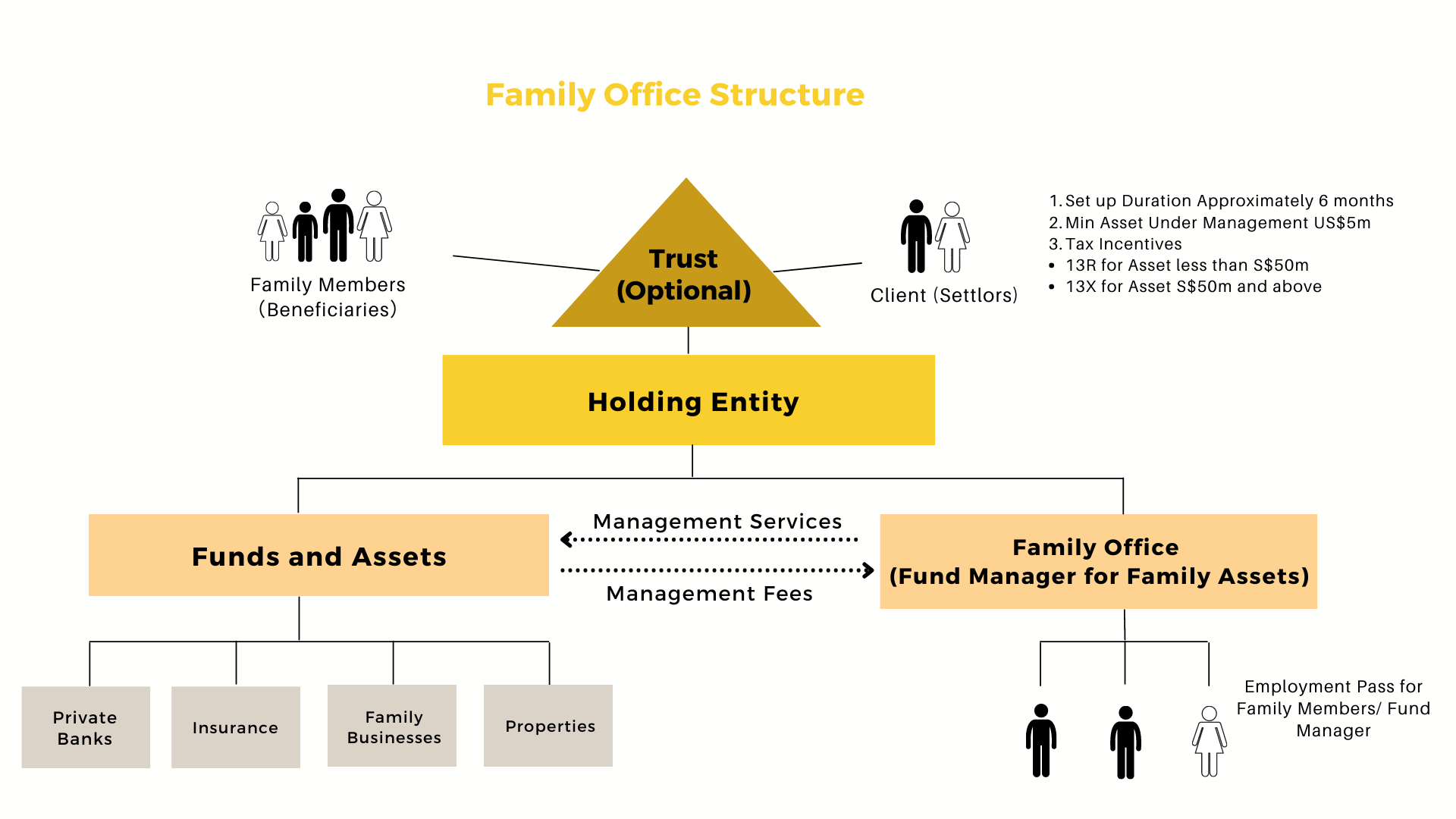

Family Office Structure

The Singapore government welcomes high-net-worth families to set up family offices in Singapore by providing tax incentives and concessions for successfully established funds.

Generally, when a Singapore based fund manager manages investments and assets of a fund, the activities of the fund manager creates a taxable presence in Singapore for said fund. This is regardless of the location of the fund (whether overseas or in Singapore). Therefore, income and capital gains of the fund may attract tax liability in Singapore as it may be considered as having been sourced in Singapore.

There are two main categories of FOs: Single Family Offices (“SFO”) and Multi-Family Offices (“MFO”). A SFO manages the assets and investments for one family and is wholly owned by the members of the same family.

Generally, a SFO is created for the management of wealth, succession planning, philanthropy and segregating personal assets from business ones for one family.

Conversely, a MFO is a privately-controlled organization that offers advisory and investment management services to more than one family in relation to the organization, management and maintenance of part or all of the families’ assets and investments.

In a bid to encourage SFOs to set up their bases in Singapore, the government has introduced several tax exemption schemes.

What are the Tax Incentives in Singapore?

Tax Incentives

The following schemes are designed to lower the tax liability of funds that associate themselves with Singapore:

- 13R of the Income Tax Act (“ITA”): Onshore Fund Tax Incentive Scheme;

- 13X of the ITA: Enhanced-Tier Fund Tax Incentive Scheme;

- 13CA of the ITA: Offshore Fund Tax Exemption; and

- Financial Sector Initiative – Fund Management (FSI-FM) Scheme

For the Monetary Authority of Singapore (“MAS”) to grant 13R and 13X tax incentive schemes on a case-by-case basis, MAS would require the following information to consider the eligibility of the applicant family office:

- description/information of the shareholding structure of the family office group (a chart showing the shareholding structure would be useful);

- description/information on how the family office is related to the investment fund vehicle and the beneficiaries;

- names of the shareholders and directors of the family office;

- description/information on the activities that will be carried out by the family office; and

- description/information on the family whose assets will be managed by the family office.

With respect to the 13CA tax incentive scheme, no prior approval is needed from the MAS.

Here is a summary of the ITA’s Tax Incentive Schemes:

| 13R | 13X | 13CA | |

|---|---|---|---|

| Fund’s Residence | Singapore Tax Resident | No restrictions | Must not be resident in Singapore, must not have any presence in Singapore (excepting the fund management company). |

| Fund’s Legal Form | Company incorporated in Singapore | Companies, trust (certain exceptions apply here), and limited partnerships. | Companies, individuals, and trusts |

| Fund Manager | Must be based in Singapore and holding a capital market services (“CMS”) licence or expressly exempted from the same. | Must be based in Singapore and holding a capital market services (“CMS”) licence or expressly exempted from the same. | Must be based in Singapore and holding a capital market services (“CMS”) licence or expressly exempted from the same. |

| Investors | Non-qualifying investors (i.e. Singapore corporate investors who invest over a prescribed percentage) have to pay a penalty. | No restrictions | Non-qualifying investors (i.e. Singapore corporate investors who invest over a prescribed percentage) have to pay a penalty |

| Assets under Management (“AUM”) | No restrictions | Min. of S$50 million | No restrictions |

| Fund Expenditure | At least S$200,000 business spending in a year. | At least S$200,000 local business spending in a year. | No restrictions |

| Approval | MAS approval required Changes in investment strategy are not allowed after approval from MAS has been obtained | MAS approval required Changes in investment strategy are not allowed after approval from MAS has been obtained | MAS approval not required |

| Reporting Requirements | Annual Statements to investors. | Not required | Annual Statements to investors |

| Income Tax Filing | Annual tax returns to IRAS. | Annual tax returns to IRAS | Not required |